Through Q3 2024, U.S. retail sales continued to increase, defying concerns that the consumer was tapped out and setting expectations for a strong finish to the calendar year. Shopping center landlords took advantage of a scarcity of vacant space to push rents and upgrade to credit quality tenants. Retail investment pricing remains relatively stable and retail CMBS delinquencies reached their lowest point since 2019.

Consumers Defy Expectations as Sales Continue to Increase

According to the U.S. Census Bureau, retail sales for September rose 3% year over year, driven in large part by e-commerce sales, which increased 7.6% for the same period. These results occurred in spite of hurricanes in the Southeast and followed a strong July (with a 6.0% year over year increase) and a solid August (with a 4.3% year over year increase), the latter supported by healthy back-to-school sales. These results defied sentiment reflected in the press at the end of the Second Quarter that consumers were tapped out. According to William Blair’s macro analyst Richard de Chazal, “Consumers continue to hang in there and ‘reluctantly’ spend – judging by the ongoing dislocation between consumer sentiment and spending patterns.” The National Retail Federation expects holiday sales’ increases year over year in the range of 2.5% - 3.5%, despite a shorter holiday shopping season this year, leading to holiday retail sales in the range of $979.5 billion - $989 billion and record annual spending in 2024 in the range of $5.23 trillion to $5.28 trillion. Per National Retail Foundation CEO Matthew Shay, “This year will be a record level of spending. The economy has been in a good place this year, operating with solid footing, and the consumer economy and the retail industry certainly continue to benefit from that strength. We know going into the holiday season that consumers continue to show resilience, and they show strength in their spending.” Lower inflation, strong job growth and lower interest rates support these findings and his conclusion.

Notwithstanding the foregoing, consumers continue to favor value-oriented alternatives. Lower-priced fitness chains, discount & dollar stores and superstores led retail categories for the Third Quarter in year over year visit growth. Meanwhile, apparel and home improvement stores saw decreases in traffic. Luxury tenants like Kering, Burberry, Capri Holdings and even LVMH suffered sales and stock share price decreases due to shoppers scaling back purchases in the wake of significant price increases over the past few years. Many of these shoppers opted for lower-priced merchandise. Similarly, fast casual concepts outpaced the growth of full-service restaurants and quick-service concepts relied upon sales and promotions to drive traffic. Higher labor costs, interest rates and occupancy costs led some chains to file for bankruptcy, even though foot traffic to restaurants overall is on the rise for the year. As noted by Moody’s Ratings Vice President of Corporate Finance Mickey Chadha, “Consumers are becoming highly selective in their spending choices. Many are pulling back from pricier, non-discretionary products to focus on value and essentials and the lower-income cohort continues to be pressured. Purposeful consumers are postponing their major shopping decisions. High-end consumers are increasingly trading down to better deals and private labels….”

NEWS | RESEARCH

Q3 2024 White Paper

U.S. Retail CRE Maintains Balance Amidst Uncertainty

FITNESS LEAD THE WAY DURING Q3

In this environment and as noted in previous SageTrust white papers, the key to attracting shoppers is for landlords and tenants to curate rich and meaningful brick and mortar experiences, in combination with online efforts. Mark Matthews, executive director for research at the National Retail Federation, comments, “No one feels like stores matter less than they did 10 years ago. In some ways, they matter more because it’s part of one ecosystem where you need to cater to the consumer.” According to JLL, in its report “Experience Matters: What’s Driving Consumer Choice and Experience Across Places and Spaces?”, “…experience can play a key differentiating role in successful real estate developments and the creation of ‘destination’ places and spaces but should be carefully tailored to the local context and expected consumer base.” Entertainment coupled with community interests and needs breeds customer affiliation and loyalty, the report suggests.

Supply Side Constraints Lead to Higher Occupancy, Rent Increases and Tenant Credit Quality Upgrades

Supply-side constraints continued to bolster retail shopping center fundamentals through the Third Quarter 2024. Year-to-date, just 6.4 million square feet of retail space has been delivered, compared to 10 million square feet last year, which was a record low. Many urban centers saw positive net absorption in the Third Quarter, which countered negative absorption in the South due to hurricanes that impacted the region. Shopping center availability remains at a historic low nationally. This leaves tenants in the market for space with limited options and landlords with the opportunity to be more selective and to increase rents.

Publicly traded REITs have reported strong results year-to-date, bolstered by occupancy metrics – including strong leasing activity, high occupancy levels and rent growth – exceeding expectations. Regency Centers President Lisa Palmer notes, “Sales and traffic trends remain steady, and leasing demand continues to be strong. We are taking advantage of this solid and consistent tenant demand to drive rent growth and leasing with strong new and existing tenants.” Landlords also are finding themselves with shorter periods of downtime and higher percentages of available space pre-leased.

In some respects, supply-side constraints have cooled off the leasing market, as nationally, net absorption is just 350,000 square feet year-to-date and store closings are projected to exceed openings for the first time in three years. Local and independent stores have found it harder to hold on to locations and compete for space as landlords push rental rates and some speculate that current market conditions may impact growth potential in the next few years ahead. According to Matthew Lapat, managing principal at tenant representative SRS Real Estate Partners, “It’s going to be an interesting couple years in terms of how the supply-demand curve plays into things, and whether we hit a breaking point where retailers push back and say, “You know what? We can’t pay $60 per square foot in a market we don’t think is worth more than $40.”

Net Absorption to Slow in 2024, Partially Due to Supply-Side Constraints and Hurricane Effects

Net absorption during Q3 2024 was estimated to be -258,000 square feet, with positive absorption in the Northeast, Midwest, West (with the exception of California) and Southwest, countered by -1.8 million square feet of negative absorption in the Southeast.

SHOPPING CENTER NET ABSORPTION

With that said, according to Cushman & Wakefield, the open-air retail availability rate at the end of Q3 2024 stood at 5.4%, in line with the Q2 2024 vacancy rate of 5.3%. (Lee & Associates estimates national retail vacancy at 4.7%,). Cushman & Wakefield projects that vacancy rates will rise to the 6.0% range in 2025, and it also indicates that asking rents averaged $24.54 at the end of Q2 2024, up 3.4% year-over-year.

OVERALL VACANCY AND ASKING RENT

Washington, D.C. Metro Performance in Line with National Statistics

Based upon data presented by Cushman & Wakefield, Washington, D.C. metro area retail trends are in line with national figures and reflect a national trend of urban revival as consumers return to cities to live, work and play. It estimates the metropolitan area open-air retail center Q3 2024 vacancy rate to be 4.4%, with 526,145 square feet under construction and an in-place inventory of 124.0 million square feet (Lee & Associates estimates Q2 D.C. retail vacancy at 4.3%, with 1.0 million square feet under construction and an in-place inventory of 272.7 million square feet). Cushman & Wakefield reports 46,896 square feet of positive net absorption through Q3 2024 for open-air retail in the Washington, D.C. metropolitan area.

Current Investment Climate Favors Retail

According to multiple research sources, retail has bounced back from the investment malaise that it experienced through the last decade and through the pandemic and has experienced more investment interest from institutional and private capital. Per connectcre, the average retail sales price decrease of 1.5% in September year over year compared favorably to other property types other than industrial and to 2023 sales price decreases in the high single digits. Furthermore, according to Marcus & Millichap, the retail sector accounted for more than 40% of sales in the $1 million to $10 million price range through the first half of the year. In addition, the number of closings between April – June rose 10% on a quarterly basis.

The debt outlook also seems more promising. Multiple media outlets report that the amount of retail CMBS behind on payments continues to recede. Sources also see lenders returning to the market. Per Altus Group’s Third Quarter 2024 Commercial Real Estate Industry Conditions & Sentiment Survey, respondents reported retail debt financing in the range of 65% LTV with coverage ratios in the 1.38 – 1.40x as achievable for debt financing.

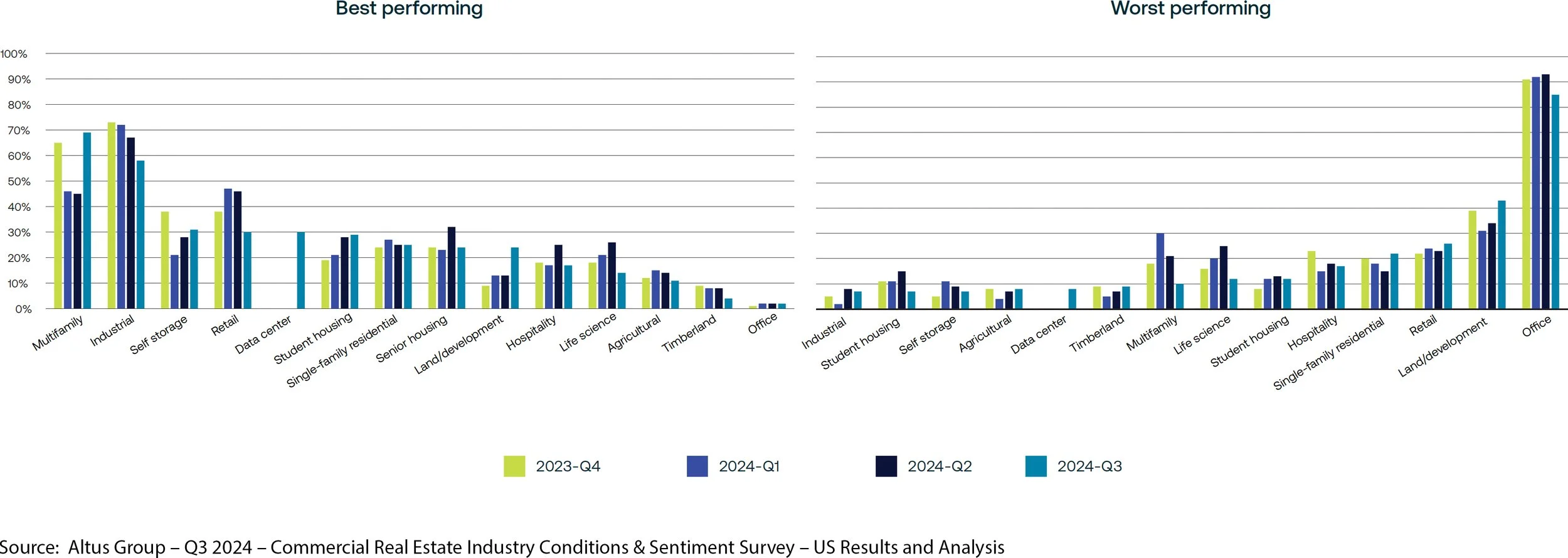

On the investment side, retail still ranks relatively favorably. Per Altus’ Third Quarter 2024 survey, only multi-family, industrial and self storage were considered to be better performing and net expectations looking forward were relatively flat in terms of net expectations to the query, “Rank which property types you expect to be the best and worst performing in the next 12 months.”

RANK WHICH PROPERTY TYPES YOU EXPECT TO BE THE BEST AND WORST PERFORMING IN THE NEXT 12 MONTHS

SageTrust Properties is actively in the market to source retail open-air property acquisition opportunities and has the capability to manage its assets. Let us know if you would like to schedule a meeting with us to discuss your needs and our capabilities further.