NEWS | RESEARCH

Q3 2025 White Paper

Affluent Spending and Supply Side Constraints Support U.S. Retail as Uncertainty Continues

The Third Quarter 2025 saw a decline in consumer confidence in the United States, amidst national job losses, decreased wage growth and fears of resurgent inflation. Consumer sales became further bifurcated between lower wage earners and wealthy households, with the top 10% of households comprising 49% of all sales. All consumers continued to seek “value,” and industry experts hypothesized what this might mean beyond price. Capital markets activity anticipated Fall rate cuts and regained momentum, as sale and debt volumes were up and pricing became more competitive, with an increasing number of institutional investors in the market.

Consumer Confidence Wanes in Face of Job Losses and Higher Inflation

U.S. consumer confidence waned during the Third Quarter 2025 in the face of negative job growth and expectations for higher inflation. According to the Conference Board’s August 26 release, the Consumer Confidence Index slipped by 1.3 points to 97.4, from a revised 98.7 in July. The Present Situation Index fell 1.6 points and the Expectations Index declined 1.2 points. Similarly, the University of Michigan Consumer Sentiment Index for September fell to 55.1 from 58.2 in August, the lowest reading since May. The Current Conditions Index slipped to 61.2 from 61.7, and the Expectations Index declined to 51.8 from 55.9.

The Conference Board’s September 30th index reflected continued negative trends, falling 3.6 points to 94.2. The Present Situation Index dropped seven points and the Expectations Index dropped an additional 1.3 points to 73.4, the eighth straight month below the 80 threshold that signals recession risk. Likewise, the University of Michigan’s October Consumer Sentiment Index reflected a small 0.1 decline from September, with a 0.5 decrease in Current Economic Conditions and a 1.1 decrease in Consumer Expectations. Year-over-year, Consumer Sentiment decreased 15.5 (22.0%), Economic Conditions decreased 3.9 (6.0%) and Consumer Expectations decreased 22.9 (30.9%).

CONSUMER CONFIDENCE INDEX

The uncertainty reflected in consumer confidence numbers also impacted sales and spending, as consumers of all income levels scaled back. Working class shoppers focused on staple purchases amid wage growth stagnation, as they struggled with rising housing and electricity costs, as well as grocery bills. Sales in general were supported by the top 10% of earners, who accounted for 49.2% of all sales in the Second Quarter. Per Liz Everett Krisberg, head of the Bank of America Institute, the wage gap between higher and lower income consumers is the largest since February 2021. According to Claire Li, a Moody’s Vice President of Credit Strategy, U.S. consumer spending, “U.S. consumer spending is not just softening overall, it’s doing so in a fragmented way…and that’s a real problem. If the benefits and the pressures are not shared broadly, then we’re not looking at a balanced or a healthy state of the U.S. consumer base.”

In light of this uncertainty, certain consumer trends stand out. According to Placer.ai, discount and dollar stores and off-price apparel are outperforming, as consumers prioritize value. Even middle income and higher income consumers are seeking out value-based alternatives. Value and value perception gives chains a clear advantage. According to Neil Saunders, Managing Director and Retail Analyst at GlobalData Retail, “Now value has always been important to the customer…And value is not price, price is part of it. But consumers are really asking themselves very deeply: What values does this product add to me in my life? What value does this product have over another product? What value is this retailer adding over another retailer? And one of the ways we’ve seen that in the data is just the time taken to make different purchases and the number of stores people will compare or browse during the purchase process. Both of these metrics have gone up….And it just shows that people are shopping around a lot more and they’re putting in a lot more thinking around what they’re buying, especially for discretionary products.” This is corroborated by work done by Placer.ai, that shows a customer willingness to visit multiple chains to benefit from each store’s signature offering – apparently, the era of one-stop shopping is waning.

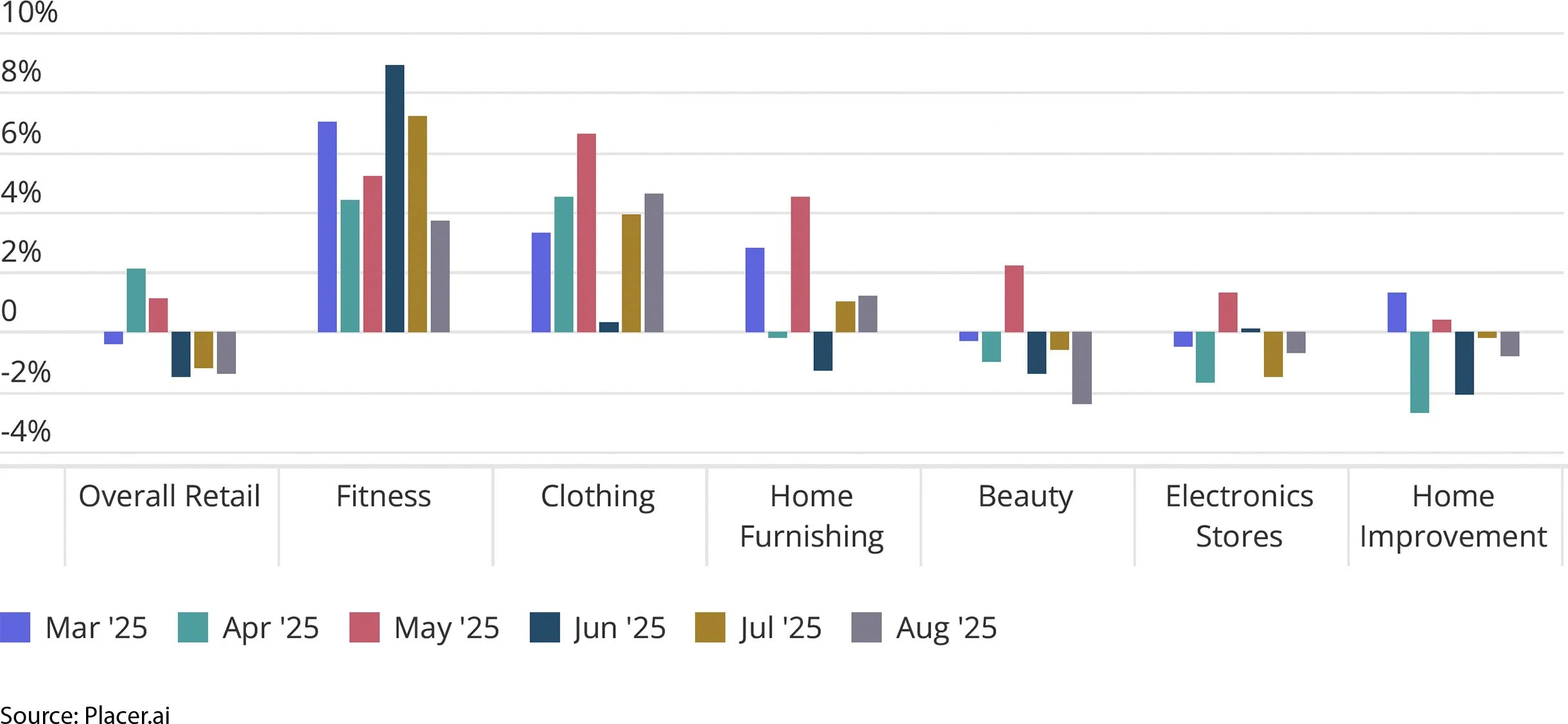

Of the discretionary categories analyzed by Placer.ai, fitness and apparel enjoyed the strongest year-over-year traffic trends, possibly boosted by the perceived value in these segments. Luxury apparel, which had lagged between 2021 – 2024, has staged a resurgence through the Third Quarter and now enjoys stronger traffic trends than traditional apparel on a year-over-year and compared to 2019. Big-ticket items, including electronics and home improvements lagged, while home furnishings visits increased over the Summer.

YEAR-OVER-YEAR CHANGE IN VISITS TO LEADING DISCRETIONARY RETAIL CATEGORIES

In the Washington, D.C. metropolitan area, CBRE’s REVIVE Regional Vibrancy Index was down 3.1% year-over-year, per its August 2025 update. This was due to a 7% drop in federal employment through the first eight months of the year, amounting to 26,000 jobs lost (this statistic does not consider the deferred resignations paid until September 30th or further terminations that occurred during the government shutdown). In addition, government contracts and other federal awards to local companies dropped by 13%, or $1.7 billion. According to Ian Anderson, CBRE’s senior director of research and analysis, “At least for employment, we know that’s going to get worse before it gets better.” According to ALXnow, an Alexandria, VA newsletter, Northern Virginia may take an outsized hit, given that the vast majority of the region’s federal workers live in Northern Virginia. Alexandria city data for July showed active home listings increased 44% year-over-year. Per Alexandria Vice Mayor Sarah Bagley, “I do worry that might be a sign of the sort of federal government cuts causing people to feel they need to leave the city.”

Positive Net Absorption and Limited Supply Keep Rents and Vacancy in Balance

Third Quarter net absorption in the United States bounced back to a positive 323,000 square feet after negative absorption for the first half of the year. Amidst continued big box retailer closures from Joann, Rite Aid, Big Lots and others, tenants filled smaller spaces to keep overall national vacancy at 5.8%. Some of the new tenants were nationals with deliberate, brand-specific strategies, while others were locals able to take advantage of availabilities. Whereas at year end 2024, 2025 closures were expected to outpace openings, as of the end of the Third Quarter, announced openings of 6,565 locations exceeded 5,633 store closings. Tenants that are growing include Uniqlo, which announced its intention to add 11 new U.S. stores in 2026, following expansion in 2024 and 2025. Coffee and beverage shops Black Rock Coffee and Dutch Bros. are in growth mode. Grocer Aldi continues its growth, with 200 new U.S. stores this year, while Sprouts plans to increase its U.S. footprint from 455 stores to 1,400 stores across 50 states. Subsequent to the called-off merger with Albertson’s, Kroger announced a 30% store increase in 2026.

SHOPPING CENTER NET ABSORPTION

Leasing activity occurred amidst continued supply side constraints, as only 7.9 million square feet was delivered year-to-date and 11.7 million square feet remains under construction. Significant growth in supply is not foreseeable in the near future, as already high construction prices are expected to increase further due to tariffs and general inflation. Debt costs are not expected to decrease significantly, subject to Fed policy, the bond markets and general market uncertainty.

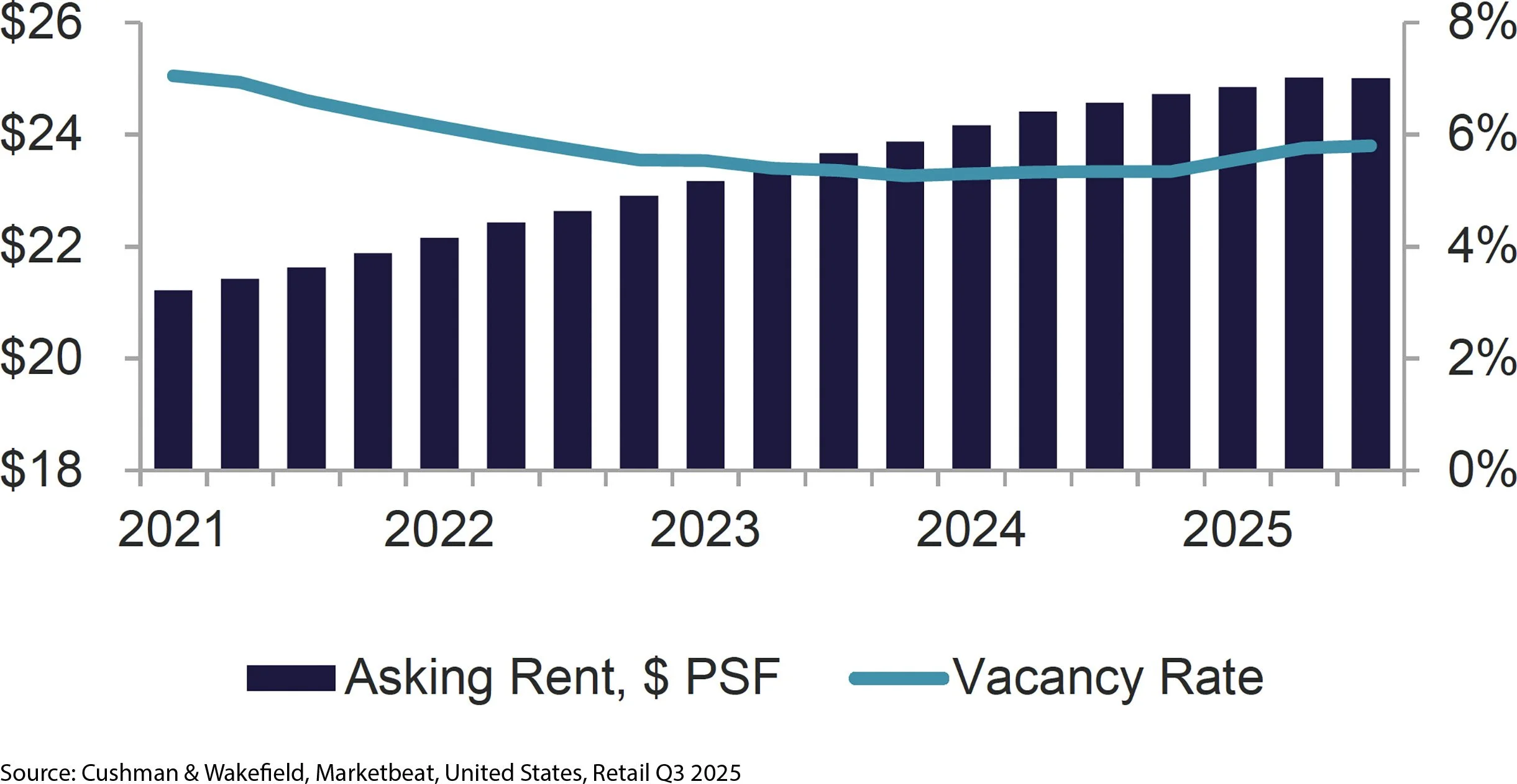

Q3 2025 vacancy ended at 5.8%, unchanged from 5.8% at the end of the Second Quarter. According to Cushman & Wakefield, asking rents in Q3 2025 averaged $25.01 per square foot, up from $24.99 per square foot at the end of the Second Quarter. Average releasing time has decreased to seven months, on average.

OVERALL VACANCY AND ASKING RENT

Washington, D.C. Metro Performs in Line with National Statistics

Based upon data presented by Cushman & Wakefield, Washington, D.C. metro area retail trends are in line with national figures. It estimates the metropolitan area open-air retail center Q3 2025 vacancy rate to be 4.5%, with asking rents of $34.29 per square foot, 459,173 square feet under construction and an in-place inventory of 122.6 million square feet (Lee & Associates estimates Q3 D.C. retail vacancy at 4.1%, asking rents at $34.08 per square foot, with 765,981 square feet under construction and an in-place inventory of 262.3 million square feet). Cushman & Wakefield reports 141,298 square feet of net absorption for Q3 2025 for open-air retail in the Washington, D.C. metropolitan area.

Retail Investment Regains Its Footing

After a lull in the Second Quarter, U.S. retail investment sales and debt markets regained their momentum in the Third Quarter. More properties came to market, lenders remained active and institutional capital became more visible, strengthening pricing. Per Lee & Associates, $10.2 billion in retail transactions occurred in Q3 2025, bringing the year-to-date total to $47.8 billion, a 31% increase year-over-year over 2024. According to connectcre, the RCA CPPI National All-Property Index indicated that retail led all product types with a 5.3% annual price increase in August year-over-year, which represented the 15th month of consecutive growth. Private debt funds have been so aggressive that most commercial banks have had trouble competing for deals. While the overall CMBS delinquency rate was 7.2% in July, up from 5.4% in July 2024, retail’s delinquency rate was in the 6% range, similar to multi-family and hospitality.

Generally, investors have been attracted to necessity-based retail’s strong demand and supply-side constraints. According to Cohen & Steers, open-air shopping centers outperformed other private real estate sectors (including industrial and multi-family) over the past 2.5 years, due to undervaluation and favorable supply/demand dynamics. It sees open-air retail as the only major property type with accelerating rental rate growth. Per John Indelli, senior director of capital markets in JLL’s Houston office, “Strip retail is like the street fighter that keeps on going. Its fundamental growth has been strong, and institutional investors are seeing that.” Most notable was Crow Holdings’ recapitalization of its 194-property, 4.5 million square foot portfolio across 30 states. In addition, Nuveen raised $320 million to buy necessity-based retail and has another $500 million in due diligence, with a goal to buy close to $1 billion of assets by the end of the year. An AEW Capital Management partnership with Mack Real Estate and Soundwater Properties has objectives to invest $350 million in neighborhood centers within the next 12 to 18 months.

In the Mid-Atlantic, JLL indicates that there was $1.3 billion of transaction volume in the first half of the year (out of $28.5 billion nationally), an 11% increase over 2024, with 75 transactions – a 35% increase over 2024. Although the average cap rate of 7.5% was down just 8 basis points from First Quarter 2025, capital markets groups and their clients were guiding pricing to sub 6.0% levels for higher quality assets.

With strong fundamentals, pricing is expected to continue to strengthen with expected successive rate cuts this Fall. Per Hessam Nadji, chief executive of Marcus & Millichap, “The market essentially froze for much of 2023 trying to figure out how to reprice real estate. The easing cycle will be a big relief.” The Real Estate Rountable’s Q3 2025 Sentiment Index reflects increased confidence among commercial real estate executives. Per Real Estate Roundtable President and CEO Jeff DeBoer, “Our Q3 Senitment Index shows that market conditions have continued to stabilize in a meaningful way….Commercial real estate executives are increasingly optimistic that the next 12 months will bring continued improvement. However, everyone is not as sanguine. According to Deloitte’s annual survey of 850 commercial real estate executives, more executives expressed concerns about macroeconomic shocks’ impacts on the availability of capital. Per Sally Ann Flood, who leads Deloitte’s real estate team, she sees more capital remaining on the sidelines, since “the recovery has paused, but is not canceled.” The 13th annual Institutional Real Estate Allocations Monitor, published by Hodes Weill & Associates and Cornell University’s Baker Program in Real Estate, indicates that institutional target allocations to real estate declined 10 basis points to 10.7% in 2025 – marking the first annual decline since the survey appeared in 2013.

SageTrust Properties believes that the uncertainty in the market provides a window of opportunity for value-add and opportunistic buyers. SageTrust Properties is actively in the market to source retail open-air property acquisition opportunities and has the capability to manage its assets. Let us know if you would like to schedule a meeting with us to discuss your needs and our capabilities further.