NEWS | RESEARCH

Q4 2023 White Paper

Retail Finishes 2023 Strong and Will Navigate 2024 Uncertainties.

Steady consumer spending, tenant demand and supply-side constraints benefited retail properties in the United States in 2023. According to Lee & Associates, available space fell 200 basis points last year, with annual rent growth of 3.3% - compared to the 2.3% average for the period 2011-2019. Limited new deliveries in 2024 should help shopping centers navigate economic challenges and present investment opportunities.

RETAIL SALES AND ASKING RENT GROWTH

Consumer Spending Continues to Drive GDP but Storm Clouds are Ahead

According to the U.S. Commerce Department, retail consumer sales increased 5.6% year-over-year in December, more than expected. Except for affluent shoppers, consumers spent cautiously on non-essentials. According to Stephen Sadove, former Chairman and CEO of Saks Fifth Avenue, “The high-end consumer is doing great, the lower end is stretched, while the middle has been squeezed into value, such as Walmart and the dollar stores.” Throughout 2023, consumer spending was fueled by the robust job market, pandemic savings, a moratorium on student loan debt and locked-in and pre-pandemic fixed rate mortgage rates. Nevertheless, over the course of 2023, total household debt increased to fuel purchases, as inflation, high interest rates and economic uncertainty took their toll. Total debt service to income ratio of U.S. households is anticipated to increase to 11.7% by 2025 from 9.9% in 2022, according to Fitch Ratings. The rating agency expects this trend will impact consumer spending in 2024. According to Olu Sonolo, head of U.S. regional economics at Fitch, “The dominance of the 15 – 30-year fixed-rate mortgage has played a significant role in blunting the impact of higher rates on aggregate household debt service; however, the sharp increase in credit card rates and the resumption of student loan payments will drive non-mortgage household debt service to historic highs in 2024. This will likely contribute to a slowdown in consumer spending in 2024.” CBRE adds that the lack of affordable housing also will impact consumer spending. The National Association of Realtor Home Affordability Index fell to a 29-momth low in August 2023.

Retailers Seek to Add New Stores, Increasingly Out-of-Mall

According to Bisnow, the consensus at the National Retail Federation’s Annual 2024 convention was that retailers’ store portfolios are expanding and investment in brick-and-mortar stores is increasing. Few retailers discussed store closures but instead expected measured growth in their portfolios. In fact, according to the Wall Street Journal and research firm Coresight Research, store openings outpaced closures for the second straight year in 2023 after years of net closures. Nevertheless, 2023 saw 20 retail company bankruptcies and it is expected in 2024 that retail companies will continue to make changes in their executive suites and pursue staff reductions in order to realize cost savings and efficiencies.

Retailers that have traditionally been mall-based increasingly are looking at smaller format, open-air suburban centers for expansion. According to GlobalData Managing Director Neil Saunders in an e-mail to Retail Dive, “There is a general trend for retailers to move off-mall and, as more centers open, this should continue across the year ahead.” According to Retail Dive, strip centers may face a perception challenge in that consumers may associate them with lower-price goods; however, retail industry consultant Shawn .Grain Carter indicates “This different retail mix can optimize foot traffic due to less apparel-focused retailers eyeing their competition.” As a result, neighborhood, community and strip centers will maintain occupancy throughout 2024, but vacancy rates for mall and lifestyle centers are expected to rise by nearly a percentage point, according to CBRE. In fact, according to Lee & Associates, general retail space and space in neighborhood centers accounted for 90% of 2023’s net absorption. Leasing activity was dominated by spaces of 3,000 square feet or less, driven predominantly by growth from quick-service restaurants. The food and beverage sector accounted for nearly 20% of all leasing activity last year, dominated by quick serve and fast casual concepts.

Net Absorption to Slow in 2024, Partially Due to Supply-Side Constraints

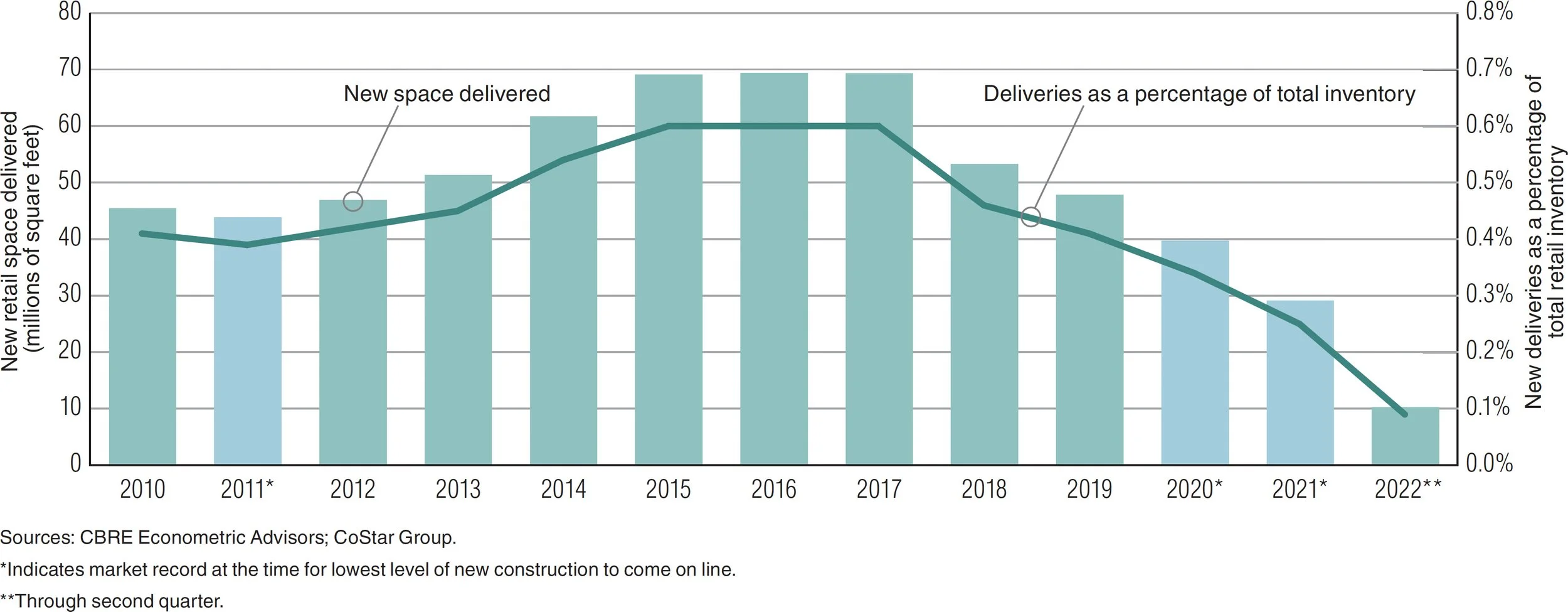

Net absorption of retail space is expected to fall to 28 million square feet in 2024 from 35 million square feet in 2023; however, only 14 million square feet of new multi-tenant retail space is scheduled for delivery in 2024, half of the projected demand. The dearth of new construction amidst improving fundamentals has been driven by high construction costs and interest rates and the lack of construction financing. According to CBRE, retail construction costs increased by 6.5% in 2023 and are expected to increase further in 2024, albeit at a slower rate.

NEW RETAIL SPACE DELIVERED AND DELIVERIES AS A PERCENTAGE OF TOTAL RETAIL INVENTORY

According to CBRE, the retail availability rate is expected to fall by 20 basis points and end the year at 4.6%, while asking rent growth is projected to dip below 2% for the first three quarters but rise above 2% in Q4 2024. According to Cushman & Wakefield, average shopping center rents stood at $23.70 per square foot in 2023, a 17% increase over 2019 levels. According to the Wall Street Journal, many landlords are seeing less of a need to offer rent discounts and other concessions to tenants and are more frequently implementing fixed base rent economic structures, with percentage rent overrides above a natural breakpoint. This is in contrast to percentage rent deals that were more evident during and after the pandemic. According to Ed Courry, senior managing director at retail brokerage firm RCS Real Estate Advisors, it is easier to fill prime retail space. “[Landlords] just say, Covid’s over; those days are done.”

HISTORICAL AND FORECAST RETAIL AVAILABILITY AND ABSORPTION

Washington, D.C. Metro Performance in Line with National Statistics

Based upon data presented by Lee & Associates, Washington, D.C. metro area occupancy trends mirror national figures, with the metropolitan area retail center year end vacancy rate at 4.4%, with 989,275 square feet under construction and an in-place inventory of 267.5 million square feet, per Lee & Associates.

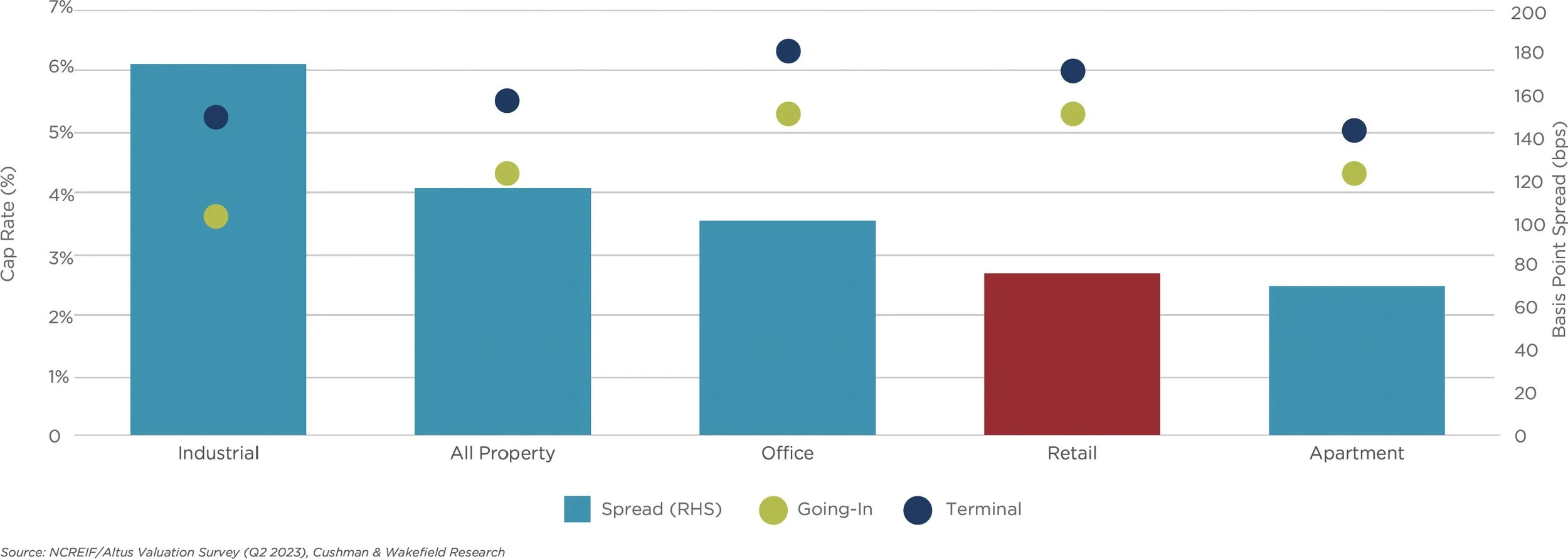

Current Investment Climate Favors Retail

Brick-and-mortar retail’s out-of-favor status prior to and during the pandemic have made the product type more attractive in today’s uncertain investment climate. Whereas the commercial real estate sector experienced a 23.5% increase in sales between 2020 – 2022 compared to the prior three years, according to Cushman & Wakefield, retail investment sales registereda 0.8% decline over the same period. Siimilarly, Cushman & Wakefield notes that retail prices between 2019 and mid-2022 rose 9.6%, compared to increases between 40% - 50% I the apartment and industrial sectors. These trends have led to pricing at higher returns presenting less negative leverage than other product types and over the past four quarters, price depreciation for retail properties has been 6.3%, or about half as much as the overall commercial real estate sector. Arguably, the “bid-ask” spread between buyers and sellers has been less pronounced than in other product categories.

SMALLER NEGATIVE SPREADS FOR RETAIL GOING-IN VS. TERMINAL CAP RATE SPREADS

Given supply side constraints, increasing tenant demand and the trend toward fixed base rent structures, retail shopping centers present an attractive investment opportunity for investors looking for income-based returns.