NEWS | RESEARCH

Q4 2024 White Paper

U.S. Retail CRE Gains Momentum

U.S. retail sales finished the year strong, buoyed by the economy and positive expectations for 2025. Leasing activity was robust and led to positive net absorption figures for the year. Capital markets professionals expect increased transaction volume in the months ahead as retail continues to offer investors more stable returns than other property types.

Holiday Shopping Season Leads to Robust Close to 2024

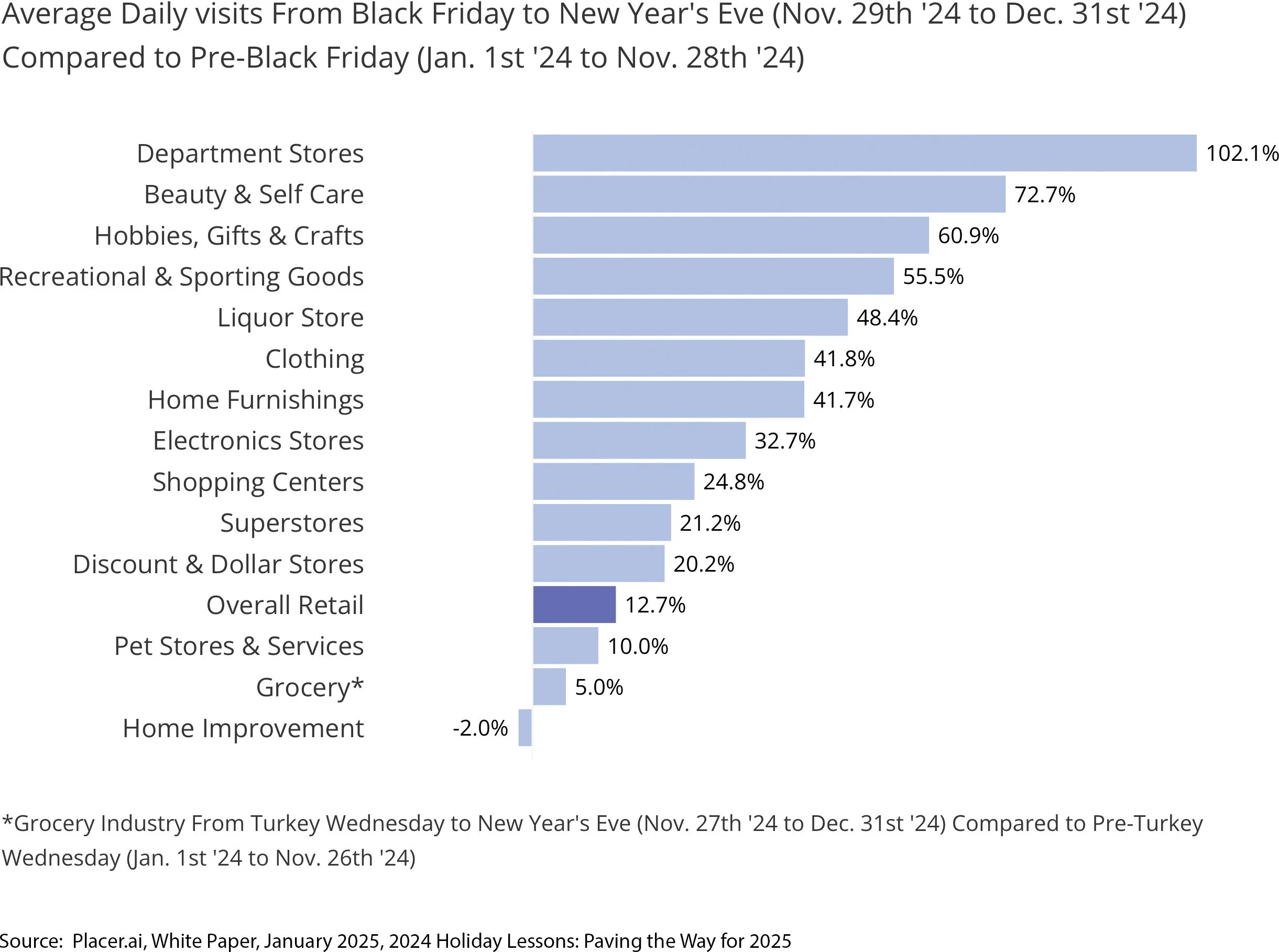

U.S. retail sales rose 3.9% year over year during Q4 2024, led by an extraordinarily strong November where sales rose 0.7% over October. Online shopping drove the increase, rising 6.7%, compared with a 2.9% increase for in-store shopping. Economists attributed this spending to a strong labor market, subsided inflation and elevated household wealth (as characterized by lower consumer/household debt delinquencies). According to Michelle Meyer, chief economist at the Mastercard Economics Institute, “The holiday shopping season revealed a consumer who is willing and able to spend but driven for value. Solid spending during this holiday season underscores the strength we observed from the consumer all year, supported by the healthy labor market and household wealth gains.” In fact, per JLL, household holiday budgets were 31.7% higher in 2024 than in 2023, with gift spending representing 46% of such budgets.

Sales at motor vehicle and parts dealers were particularly strong, followed by department stores, beauty & self care, retailers selling sporting and hobby items, furniture/home furnishings retailers and clothing retailers.

DEPARTMENT STORES DOMINATE THE HOLIDAY SEASON

According to Barron’s, consumers may have been allocating a bigger share of their budgets toward gift buying rather than dining out or groceries, as these two latter categories saw sales declines. Concessions and sales also played a role. According to Steve Sadlove, senior advisor to Mastercard, “This holiday season, we saw consumers motivated by deals and retailers respond with promotions to meet the demand.” Although luxury retail sales slowed through the Third Quarter 2024, many brands experienced a rebound during the Fourth Quarter, especially with regard to jewelry, where sales increased 10% over 2023. Per Joanne Hsu, director of consumer surveys at the University of Michigan, wealthier households felt more comfortable making discretionary purchases during the holiday season due to stock market gains and house price appreciation.

According to Placer.ai, the gap between high end and budget shoppers may be narrowing, as consumers increasingly seek value in terms of product, price, convenience and experience. The former seemingly limitless growth of dollar and discount stores seems to be slowing, perhaps as a resut of changing neighborhood demographics. As noted by Lululemon CEO Calvin McDonald, “the consumer is looking for value, quality and experience. Those brands that don’t provide this will fall behind – the chasm between the have and have-nots will grow.” For example, innovative specialty grocers like Trader Joe’s, Sprouts Farmers Market and Great Wall Supermarket have earned customer loyalty by offering low prices, new products, unique deals and what Placer.ai characterizes as “surprises, indulgences and entertainment.” The three chains offer quality and value and have seen an increase in their respective share of visits from shoppers traveling 7+ miles, as customers have displayed a willingness to prioritize special trips over more convenient options and also shop at multiple stores. Stores like Whole Foods and Macy’s have introduced smaller store formats to capitalize upon strong real estate locations and curate merchandise to local markets. Resurgent legacy brands like Anthropologie, Abercrombie & Fitch and Barnes & Noble have introduced innovative products and experiences to resuscitate brand equity and leverage people’s emotional attachments. Similarly, numerous news outlets reported on increased visitation at malls in 2024, led by Generation Z shoppers who recognize the multiple advantages of in-person shopping (including sales help, merchandise in hand, and easy returns), as well as the social benefits of a physical “third place.” The mall remains a community center.

With regard to dining out options, all restaurants were challenged by high food and labor costs. The fast casual sector continued to dominate, led by innovators Cava, Chipolte and Sweetgreen. According to Bisnow, fast-casual chains are experiencing a 6.6% compound annual growth rate, leading to an outsized share of the restaurant sector. Per Vivek Sinha, a partner with retail estate developer Banyan, “We speak of it anecdotally, about fast-casuals coming up and taking over, but the growth in market share in same-store sales….and the compounded annual growth rates far outpace sit-down restaurants to the point that they’re becoming a dominant force. They’re small setups, but to some extent, they’re taking over markets.” Placer.ai expects that the fast casual segment and quick serve chains will continue to experiment with automation to try to reduce labor costs, increase efficiency and reduce waste, while still prioritizing personal contact with customers.

In this environment and as noted in previous SageTrust white papers, the key to attracting shoppers is for landlords and tenants to curate rich and meaningful brick and mortar experiences, in combination with online efforts. Mark Matthews, executive director for research at the National Retail Federation, comments, “No one feels like stores matter less than they did 10 years ago. In some ways, they matter more because it’s part of one ecosystem where you need to cater to the consumer.” According to JLL, in its report “Experience Matters: What’s Driving Consumer Choice and Experience Across Places and Spaces?”, “…experience can play a key differentiating role in successful real estate developments and the creation of ‘destination’ places and spaces but should be carefully tailored to the local context and expected consumer base.” Entertainment coupled with community interests and needs breeds customer affiliation and loyalty, the report suggests.

Strong Fourth Quarter Performance Closes the Year on a High Note and Encourages Optimism for 2025

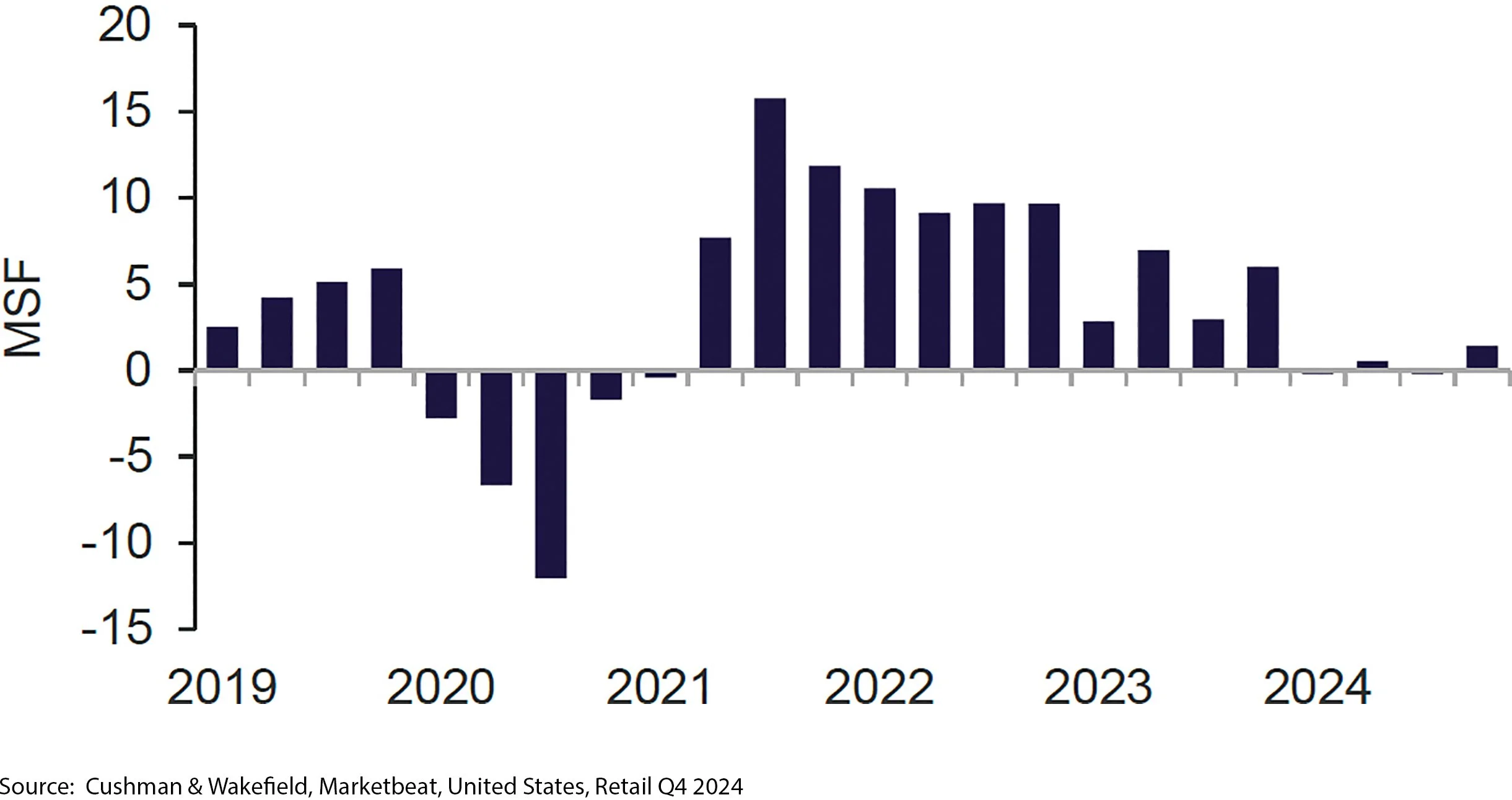

U.S. open air retail finished the year strong with 1.4 million square feet of net absorption, accounting for 89% of the 2024 total of l1.6 million square feet. Most of this leasing activity occurred in the Northeast and Midwest, as other parts of the country experienced softer conditions.

SHOPPING CENTER NET ABSORPTION

This leasing activity occurred amidst continued supply side constraints, as a record low 8.3 million square feet was delivered last year. Given that only 10.6 million square feet remains in the pipeline and current construction pricing and debt costs make new construction difficult, these conditions should be prevalent for some time to come.

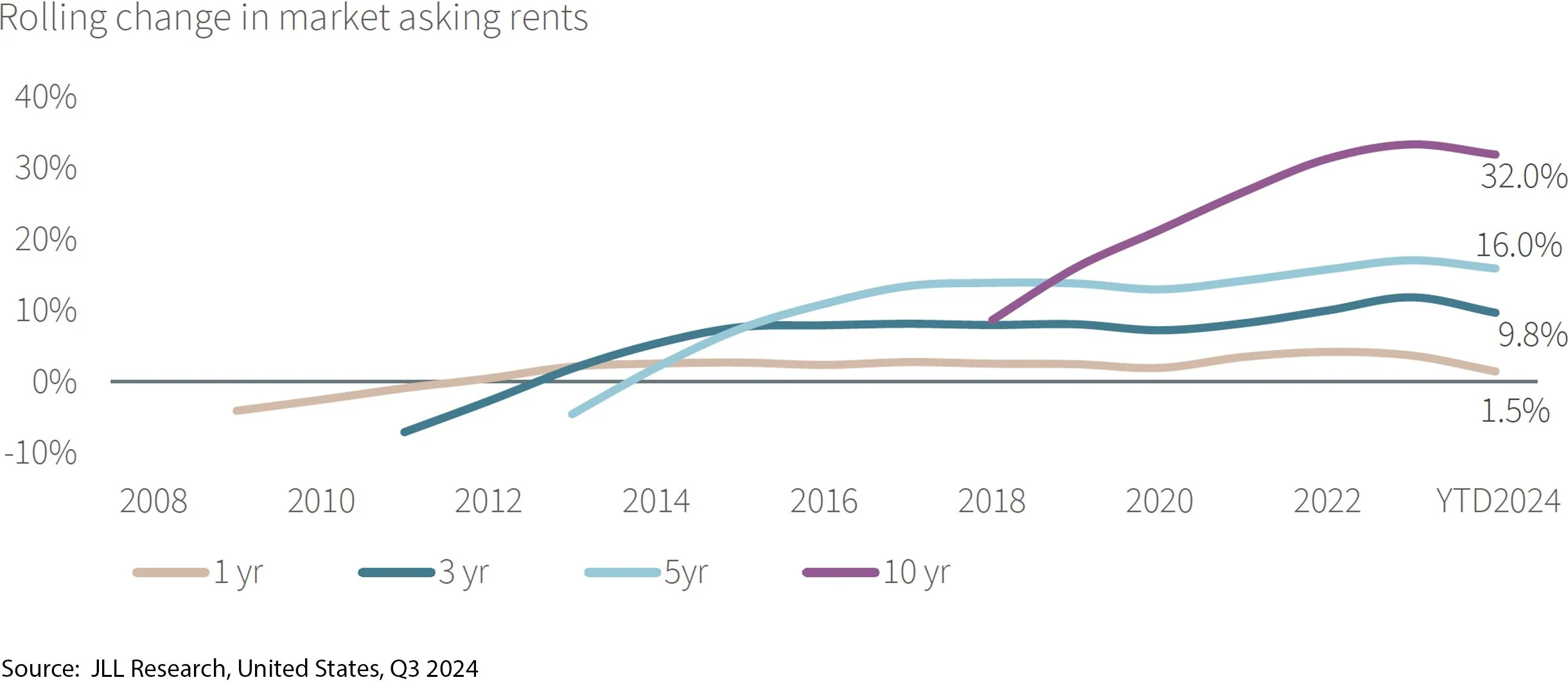

In 2024, the U.S. experienced 7,300 store closures, a 70% increase over 2023 and exceeded the 5,970 new store openings. Notwithstanding the foregoing, vacancies were quickly backfilled – often at significantly higher rents (up to 32% higher face rates) and more landlord-favorable terms. According to a spokesperson for investment manager Cohen & Steers, “Property owners in the retail space now have the leverage. Tenant improvement allowances are coming down. Costly co-tenancy clauses are getting weeded out. Percentage rent deals are becoming more rare. We expect accelerating rent growth as strong demand meets very limited supply.”

RETAIL MARKET RENT SPREADS SOAR

The year ended with the national vacancy rate at 5.4% and 11 markets with vacancy rates below 4%. According to Cushman & Wakefield, asking rents in Q4 2024 averaged $24.59 per square foot.

OVERALL VACANCY AND ASKING RENT

Washington, D.C. Metro Performs in Line with National Statistics

Based upon data presented by Cushman & Wakefield, Washington, D.C. metro area retail trends are in line with national figures. It estimates the metropolitan area open-air retail center Q4 2024 vacancy rate to be 4.2%, with asking rents of $34.25 per square foot, 505,995 square feet under construction and an in-place inventory of 124.0 million square feet (Lee & Associates estimates Q4 D.C. retail vacancy at 4.2%, asking rents at $34.08 per square foot, with 1.4 million square feet under construction and an in-place inventory of 273.5 million square feet). Cushman & Wakefield reports 312,413 square feet of positive net absorption for 2024 for open-air retail in the Washington, D.C. metropolitan area. According to JLL, Washington, D.C.’s 3.5% positive rent growth in 2024 ranked ninth in the U.S. in 2024.

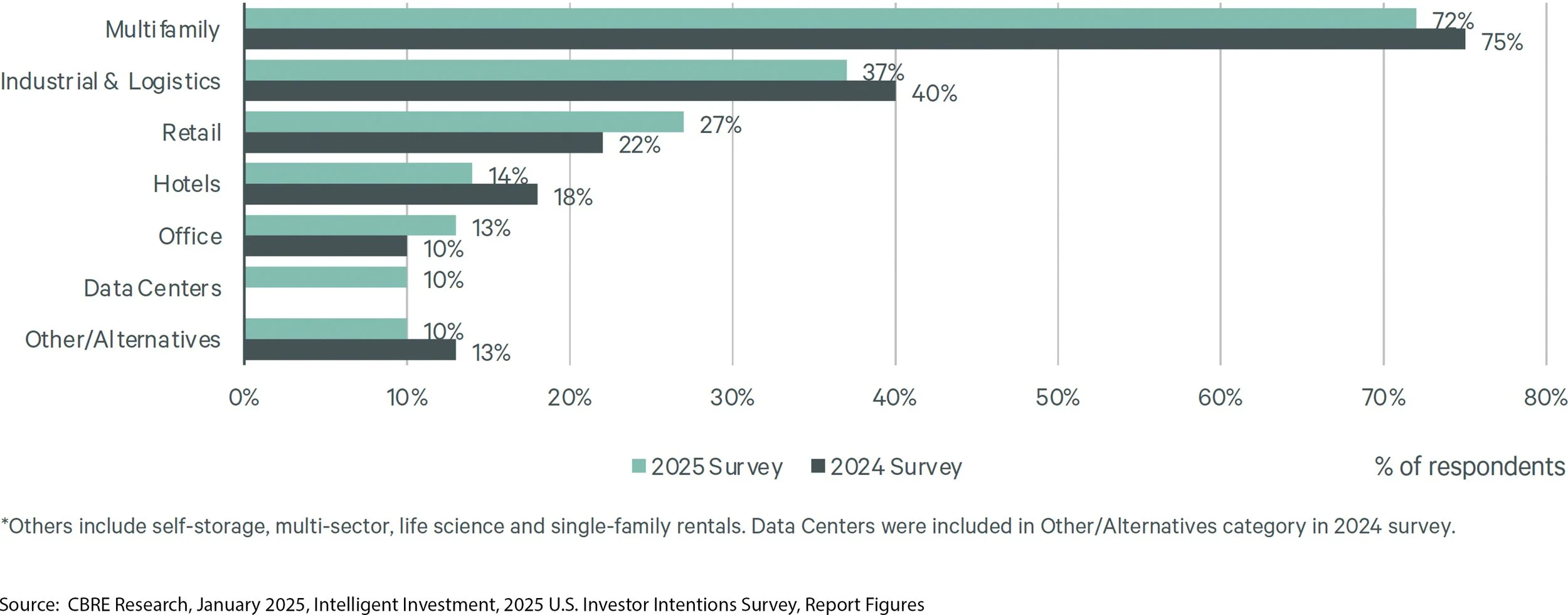

Retail’s Resilience Attracts Increasing Investor Interest

Press reports regarding public retail REIT’s stellar performance, favorable supply/demand dynamics and recognition of the benefits of retail’s current cash flow led to increased investor interest and increased allocations to retail. Investment manager Cohen & Steers, for example, completed seven shopping center purchases last year. Private Real Estate Group Head James S. Corl commented, “We believe that valuations in the open-air shopping center sector are attractive, and the market is revealing compelling investment opportunities.” During the Fourth Quarter, Blackstone announced the $4 billion acquisition of Retail Opportunity Investment Corp., that owns and operates a portfolio of grocery-anchored shopping centers – grocery-anchored shopping centers rank as the most favored retail investment. Per Blackstone’s Global Co-Head of Real Estate Nadeem Meghji, “We’ve been cautious on U.S. regional malls for over a decade, given some of the headwinds relating to e-commerce. But grocery-anchored shopping centers offer a different value proposition, and fundamentals in the space are as strong as we’ve seen in several years.”

According to CBRE’s 2025 U.S. Investors Intention Survey, retail ranked as the third most favored property sector, behind multi-family and industrial/logistics.

PROPERTY SECTORS TARGETED FOR INVESTMENT IN 2025

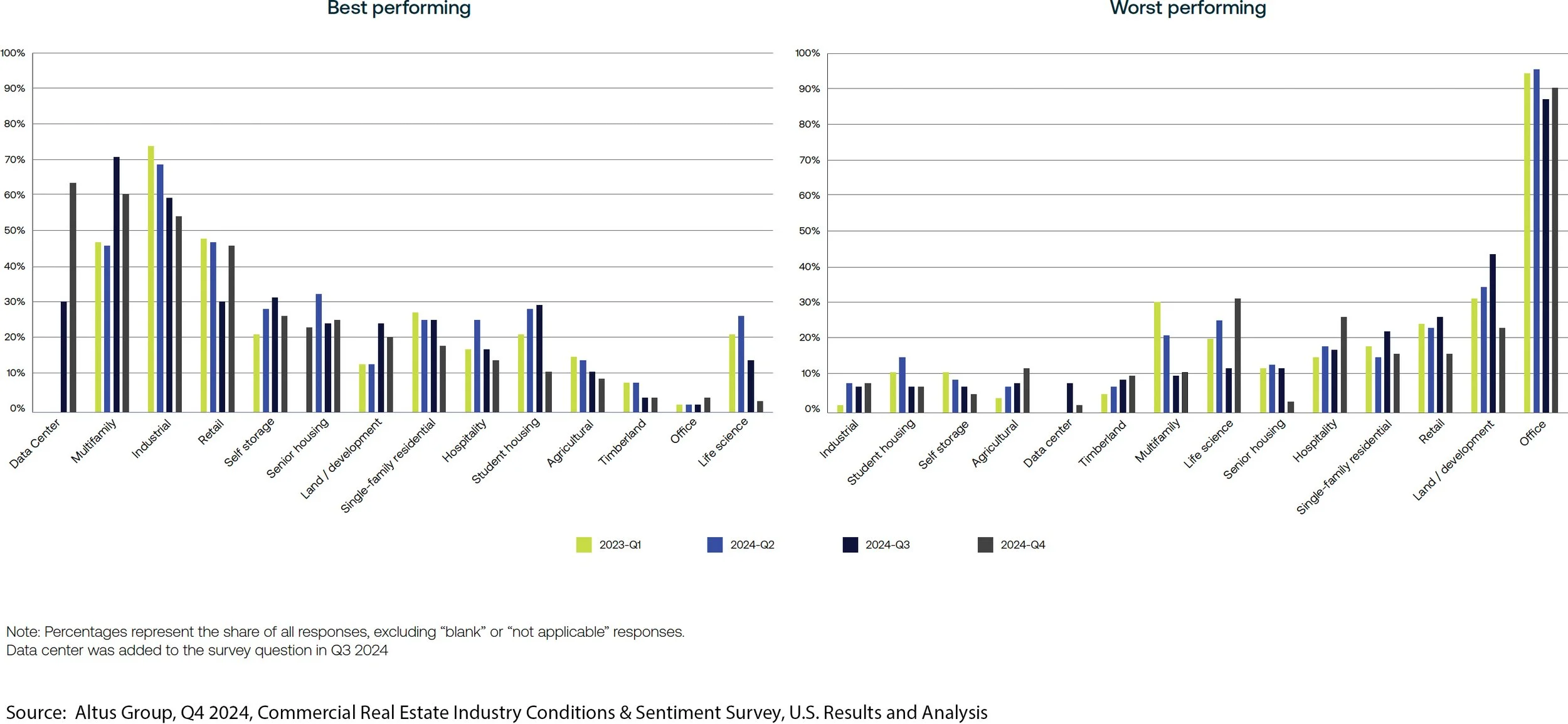

According to Altus Group’s Q4 2024 Commercial Real Estate Industry Conditions & Sentiment Survey, retail is anticipated to be the fourth best performing property type, behind data centers, multi-family and industrial.

RANK WHICH PROPERTY TYPES YOU EXPECT TO BE THE BEST AND WORST PERFORMING IN THE NEXT 12 MONTHS

The number of deals in the market increased during the Fourth Quarter 2024 and is anticipated to increase further in 2025, with investors indicating a desire to deploy capital. This may be a function of buyers and sellers sharing similar expectations, as 78% of Altus survey respondents judged that retail assets are “fairly-priced” – the highest characterization relating to any property sector. According to CBRE’s 2025 survey, at least $10 billion worth of U.S. open-air retail portfolios are expected to change hands in 2025. According to Chris DeCoufle, CBRE’s managing director of U.S. retail capital markets, “There are many open-air retail deals occurring with five to six banks actively bidding for the financing. Six months ago, there were zero banks playing unless deposits and guarantees were on the table.”

As indicated by the quote above, the debt outlook also continues to improve. Media sources see bank and non-bank lenders returning to the market. Per Altus Group’s Fourth Quarter survey, respondents reported retail debt financing in the range of 69% LTV with coverage ratios in the 1.31x as achievable for debt financing.

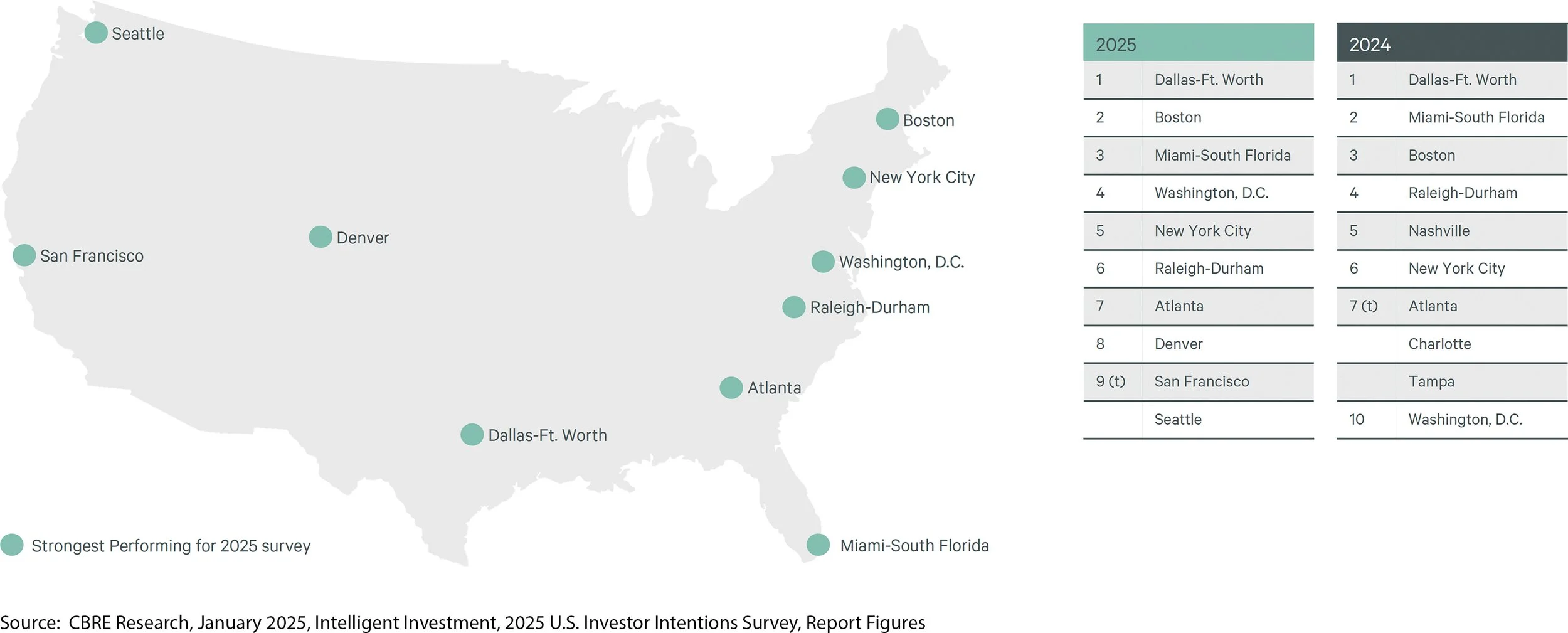

These trends also are apparent in the Washington, D.C. MSA. According to Newmark, the Washington, D.C. MSA presently ranks seventh in the U.S. in terms of retail investment volume. Similarly, per CBRE’s 2025 survey, Washington, D.C. ranks as the fourth highest market for total property returns nationally.

TOP 10 MARKETS FOR HIGHEST TOTAL PROPERTY RETURNS

SageTrust Properties is actively in the market to source retail open-air property acquisition opportunities and has the capability to manage its assets. Let us know if you would like to schedule a meeting with us to discuss your needs and our capabilities further.