NEWS | RESEARCH

Q4 2025 White Paper

Strong Holiday Sales and Positive Net Absorption Trump Weak Consumer Confidence and Job Growth

The Fourth Quarter 2025 started off on weak footing, as federal government job losses and the shutdown hampered growth and sowed uncertainty in the economy. Although consumer confidence remained low, retail sales were strong over the Thanksgiving holiday weekend and strong retail leasing overcame the negative absorption that characterized the first half of the year. Increased investment sales volumes and lender activity should lead to continued positive outcomes in 2026, with market experts predicting cap rate compression, particularly for grocery anchored shopping centers offering core-plus/value add returns.

Consumer Confidence Wanes in Face of Job Losses and Higher Inflation

U.S. consumer confidence started off the Fourth Quarter at the lowest level since June 2022, as the government shutdown intensified anxiety about inflation, the labor market and the economic outlook. According to William Blair analyst Sharon Zackfia, “This steep increase in pessimism suggests growing concern among consumers, likely driven by persistent inflation, geopolitical uncertainty, and tariff-related disruptions.” Within 30 days, however, consumer sentiment improved, led by a 13% rise in expected personal finances, with improvements visible across age, income, education and political affiliation. Notwithstanding the foregoing, national sentiment remained more than 20% below the 2024 figures, as consumers continued to report pressures on their purchasing power stemming from high prices and the prospect of weakening labor markets. According to the Conference Board, U.S. Consumer Confidence fell sharply by 9.7 points in January, with the Present Situation Index dropping 9.9 points to 113.7 and the Expectations Index falling 9.5 points to 65.1, well below the threshold of 80 that usually signals a recession ahead. Hiring was slow in December, with the U.S. Bureau of Labor Statistics reporting a gain of just 50,000 jobs. According to Joanne Hsu, the director of the University of Michigan’s Surveys of Consumers, “the overall tenor of views is broadly somber, as consumers continue to cite the burden of high prices.”

CONSUMER CONFIDENCE INDEX

Given this sentiment, it was initially surprising that Black Friday retail sales were up 4.1%, compared to 2024, and consumer related spending increased a moderate 3.0% year-over-year in the Fourth Quarter, with 73% of purchases taking place in physical stores (per Visa Analysis and Mastercard Spending Plus). Strong holiday sales were anticipated by the National Retail Federation, since holiday shopping typically is a planned purchase. President Michael Shay noted, “Holiday shopping is an essential part of the budget. It’s an emotional purchase families plan for-families save for.” According to the Wall Street Journal, purchases were driven by high-end luxury shoppers and deal hunters making everyday spending trade-offs to keep gifts flowing. Per John Beurerlein, chief economist at Pohlad Companies, “the stronger spending has mainly been coming from the higher-income sector of the economy. The lower- and middle-income sectors have become increasingly strained as prices are elevated and the labor market has been cooling….” For lower income shoppers, routine purchases were cut back to give priority to gifts and holiday meals. In turn, although people expected to have to spend, well over a third of holiday shoppers planned on buying more on sale, and the money-saving mindset had many waiting around for promotions before making a purchase. Per Macy’s Chief Executive Tony Spring, “There is more of a waiting game that occurs for the best value and best promotion.”

Location analytics for the 2025 holiday season suggest that shoppers consistently gravitated toward retailers that delivered clear value – whether through low prices, strong quality-to-price ratios or products tied to personal utility and well-being. Traffic data supports these assumptions, with Placer.ai reporting that thrift stores and off-price retailers led apparel stores with traffic up 11.7% and 6.6%, respectively. Luxury chains and department stores posted modest gains (1.8%), while traditional apparel chains saw slight declines (-1.8%) and mid-tier department stores experienced more pronounced traffic drops (-6.2%). Open-air shopping centers saw the highest traffic gains (1.7%), perhaps due to an ability to offer a more festive, experiential atmosphere and a wider mix of dining options.

In the Washington, D.C. metropolitan area, CBRE’s REVIVE Regional Vibrancy Index was down 1.9% in October, per its December 2025 update, reaching its lowest level since March 2024. This was due to a broad range of negative indicators, including commercial real estate, federal government job cuts, federal government contracting and hotel occupancy. With regard to commercial real estate, multiple data points tracking sales transactions indicated a slower pace of investment, likely reflecting heightened caution among investors due to regional challenges and the federal government shutdown. According to the Washington Post, unemployment rose through the Summer to reach nearly 7.0% by early Fall, a level last seen in 2021. Consumer spending declined and the region saw the largest increase in home sale listings of any major metro area. Per Yesim Sayin, executive director of the D.C. Policy Center, “This isn’t just a blip. What this year has done is change the trajectory of the District’s economy.” On a positive note, movement of residents and visitors across the region rebounded in October after sharp declines in August and September. Metro ridership increased and the CBRE REVIVE Regional Vibrancy Washington, D.C. Street Activation sub-composite climbed to its highest post-pandemic level in October, driven by stronger movement of residents and visitors through the District’s streets, higher Metro ridership, lower crime, stabilization of retail-based employment and higher retail occupancy.

Exceptionally Strong Net Absorption and Limited New Supply Motivate Developers to Consider New Construction

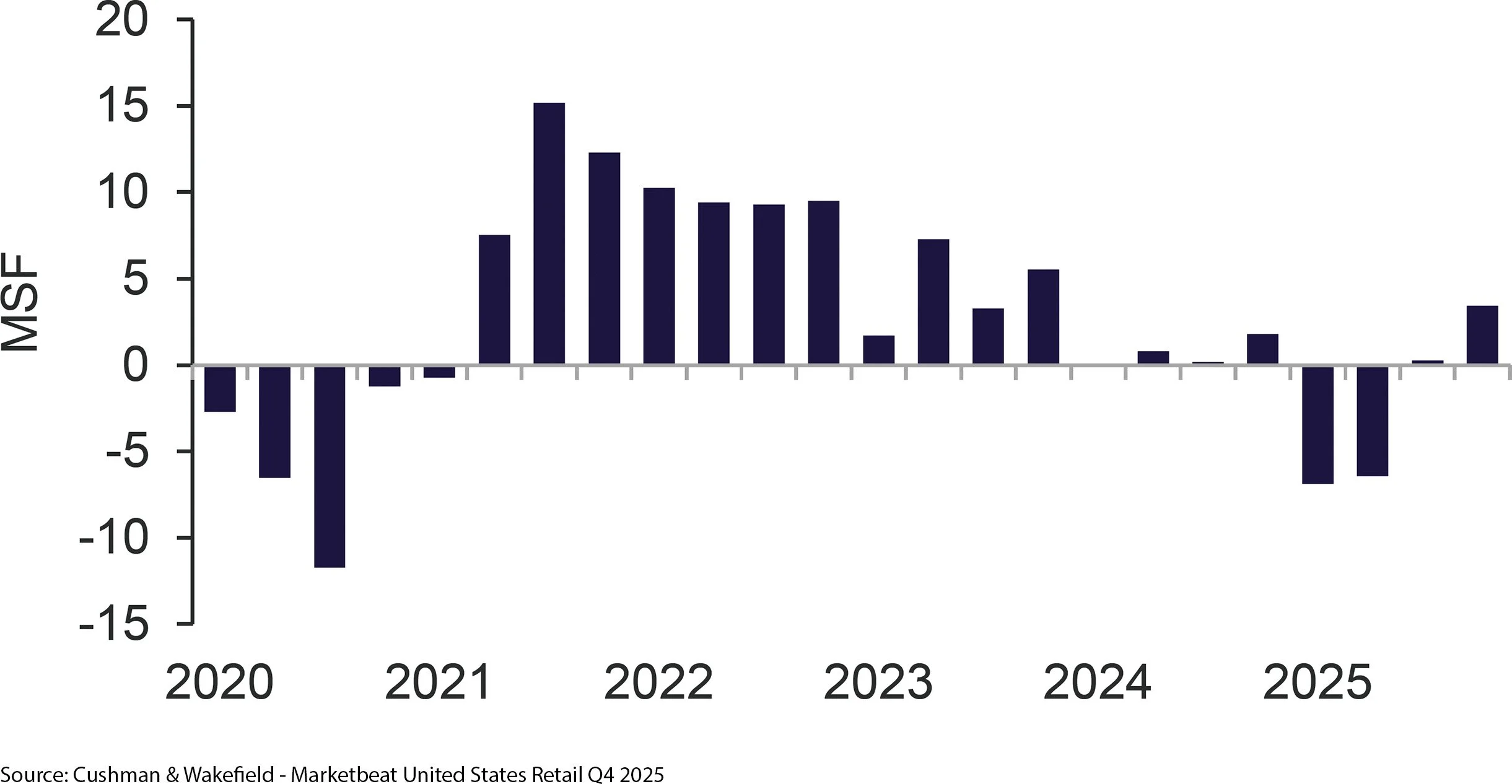

Fourth Quarter retail net absorption in the United States roared to a positive 3.4 million square feet, the strongest performance since Fourth Quarter 2023. Nearly 50% of all store openings, by square footage, came from discount stores, grocery retailers and convenience stores, reflecting consumers’ price consciousness and focus on value.

SHOPPING CENTER NET ABSORPTION

Leasing activity occurred amidst continued supply side constraints, as only 10.2 million square feet was delivered year-to-date and 12.7 million square feet remains under construction. Significant growth in supply is not foreseeable in the near future, as already high construction prices are expected to increase further due to tariffs and general inflation. Debt costs are not expected to decrease significantly, subject to Fed policy, the bond markets and general market uncertainty.

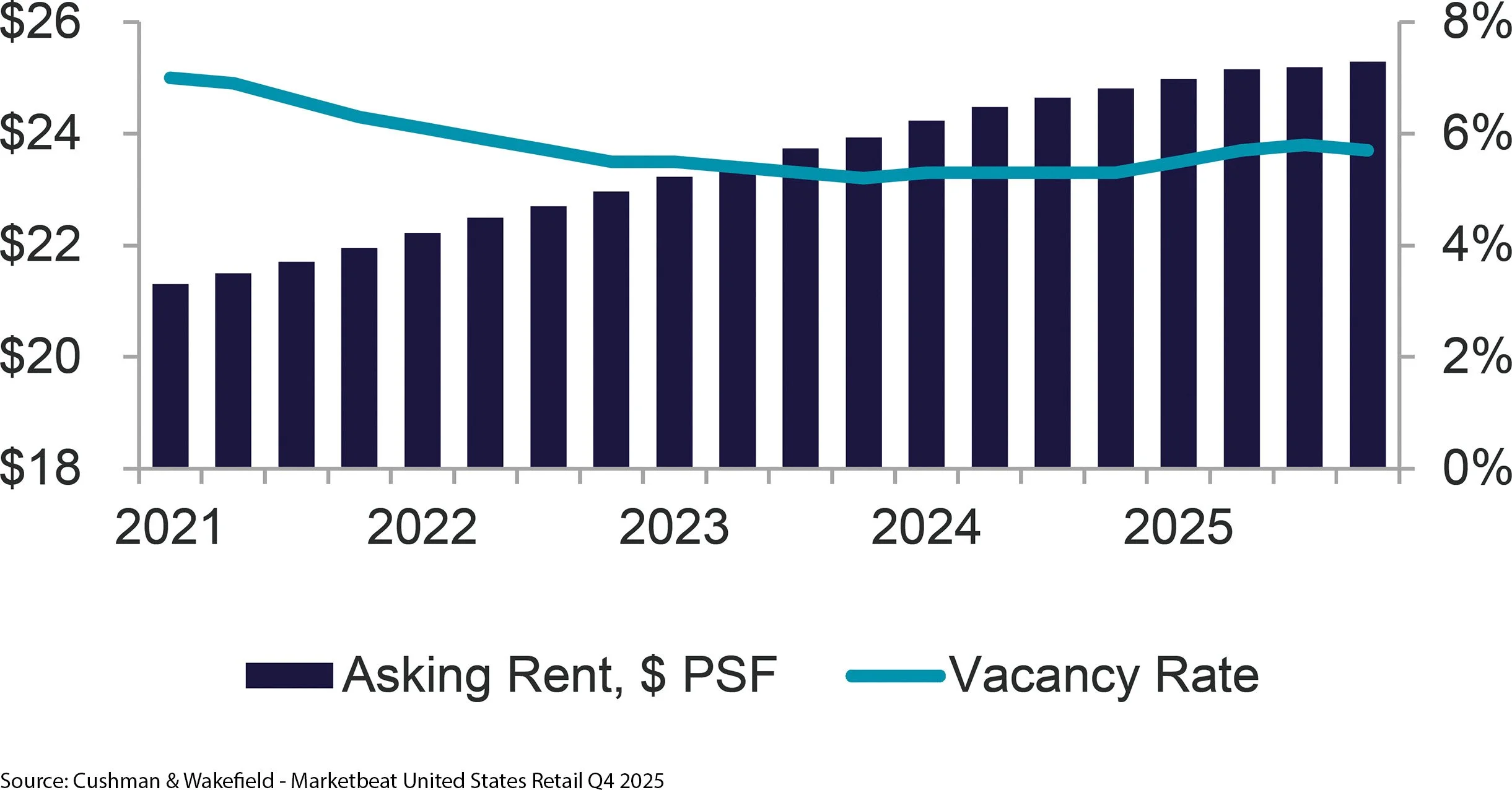

Q4 2025 vacancy ended at 5.7%, down slightly from 5.8% at the end of the Third Quarter. According to Cushman & Wakefield, asking rents in Q4 2025 averaged $25.29 per square foot, up from $25.01 per square foot at the end of the Third Quarter. Average releasing time held steady at seven months, on average.

OVERALL VACANCY AND ASKING RENT

Washington, D.C. Metro Performs in Line with National Statistics

Based upon data presented by Cushman & Wakefield, Washington, D.C. metro area retail trends are in line with national figures. It estimates the metropolitan area open-air retail center Q4 2025 vacancy rate to be 4.6%, with asking rents of $35.16 per square foot, 301,297 square feet under construction and an in-place inventory of 123.3 million square feet (Lee & Associates estimates Q4 D.C. retail vacancy at 4.3%, asking rents at $34.65 per square foot, with 654,001 square feet under construction and an in-place inventory of 263.8 million square feet). Cushman & Wakefield reports 31,539 square feet of net absorption for Q4 2025 for open-air retail in the Washington, D.C. metropolitan area.

Retail Investment Maintains Its Footing

U.S. retail investment sales and debt markets remained relatively stable, with volumes down and pricing increases slightly lower than those for the Third Quarter 2025. According to connectcre, the RCA CPPI National All-Property Index indicated that retail prices increased 4.7% year-over-year in October, behind only industrial. According to MCSI Real Assets, “In a year defined by cautious optimism among investors due to improving financial conditions, the outlook more recently has been clouded by uncertainty following the government shutdown and the resulting lack of economic data. Deal volume fell 22% Y-O-Y in October; however, investors continue to be willing to pay higher prices for the assets.”

Investors continued to be attracted by open-air retail’s cash-driven returns and generally lower capital requirements. Many pursued portfolio-driven strategies. Of note was MCB Real Estate’s acquisition of Epic Real Estate Partners in early January 2026, which added 2.2 million square feet of shopping centers, comprising 15 properties nationally, to its portfolio. Blackstone, Bain Capital, Nuveen and others continue to be active in the market. Brentwood, TN-based GBT Realty Corp. announced plans to deploy $1.3 billion to develop build-to-suit retail properties and acquire shopping centers over the next 18 months.

The Real Estate Roundtable’s Sentiment Index for the Fourth Quarter 2025 registered an overall score of 67, equivalent to the prior quarter, reflecting that commercial real estate executives’ sentiment has shifted from caution toward guarded optimism as markets stabilize, transaction activity resumes and expectations build for easing interest rates in 2026.

Debt financing continued to become more available to commercial real estate. The CBRE Lending Momentum Index, which tracks CBRE-originated commercial loan closings in the U.S., increased 67% year-over-year at the end of the Fourth Quarter 2025. The growth was driven by a 26% year-over-year increase in permanent loan financing. Private debt funds and mortgage REIT’s led CBRE’s non-agency loan closings in the Fourth Quarter 2025, accounting for 40% of total volume. Banks held the second-largest share of non-agency loan closings at 35%, with bank origination volumes up 73% quarter over quarter. Life companies followed with 19% of non-agency loan volume.

At the same time, CMBS delinquency rates continued to move higher. According to Trepp CMBS Research, CMBS delinquency ended 2025 at 7.30%, with stress most pronounced in office at 11.76%. Retail delinquency ended the year at 7.06%, with malls coming in at 11.2%. More than $100 billion in CMBS loans are scheduled to mature in 2026, but many loans originated at peak valuations are expected to be modified or extended.

In the Mid-Atlantic, a slew of headwinds has commercial real estate investors watching and waiting to see what the full impact will be on the Washington, D.C. metropolitan region. According to Michael Vu, principal at Artemis Real Estate Partners, “We would rather wait and see how the demand side of the equation plays out after maybe a couple years of Trump policy.” Nuveen Green Capital Managing Director Aaron Kraus added, “I think vibes matter. When you go to your investment committee, you say you want to put ‘at risk’ on a spec property, and it’s D.C., it's going to get a very, very different reaction than if you’re in Dallas or you’re in Canada. That’s just the reality.” Although retail investment sales increased 10.6% year-over-year from 2024, volume was down 38.4%, according to Newmark. Sales prices generally fell within a $241 - $641 per square foot band, with cap rates between 6.32% - 7.67%. Per Newmark, over 60% of 2025 investment sales in the Washington, D.C. MSA were to private buyers, with 21.0% awarded to institutional investors.

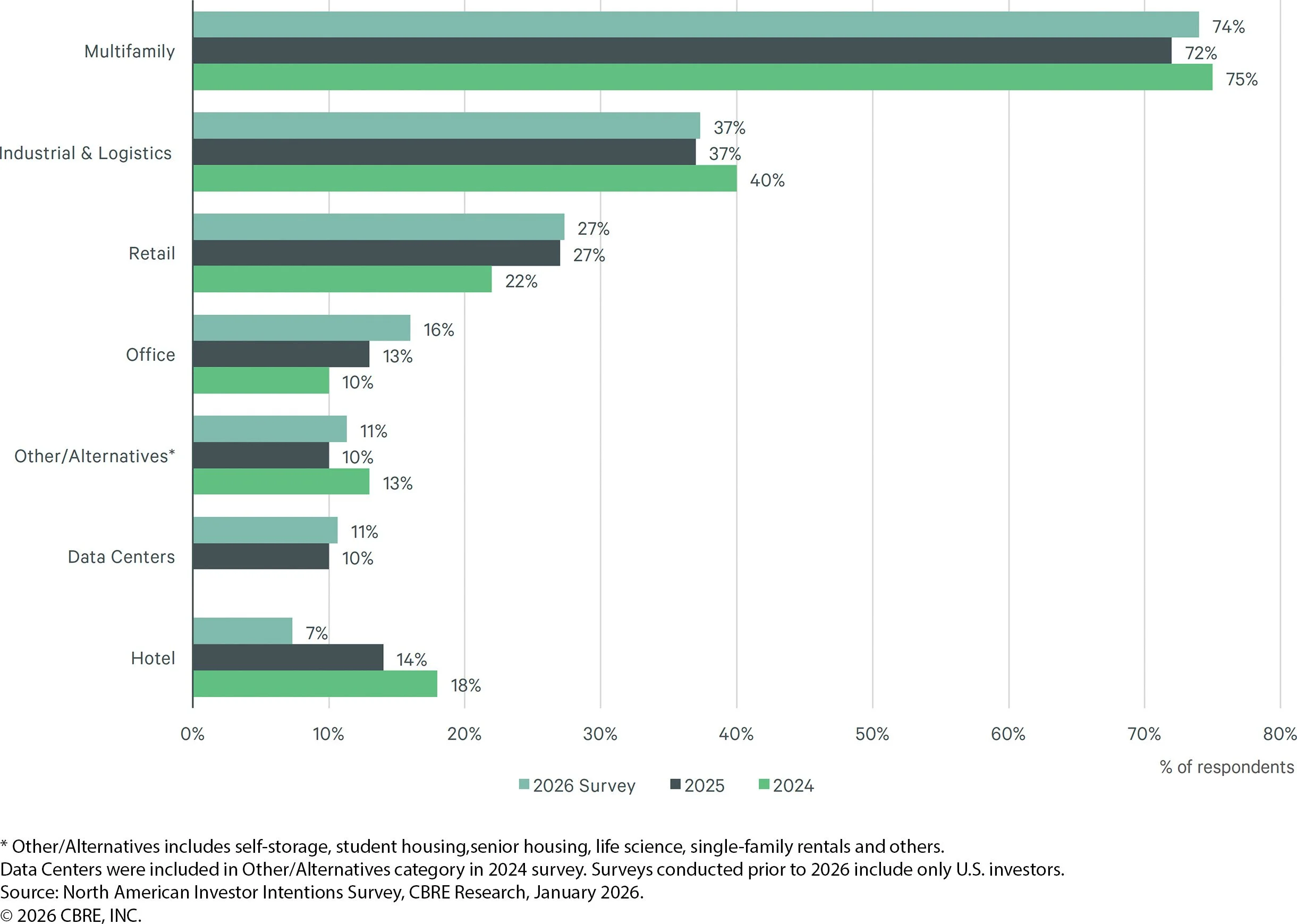

In 2026, most investors plan to maintain or increase transaction activity. According to CBRE’s 2026 North American Investor Intentions Survey, 55% of investors plan to increase their capital allocations to real estate, driven by stabilizing interest rates, ample liquidity, attractive pricing relative to other asset classes and cyclical opportunity. Roughly one-third of investors plan to pursue both value-add and core-plus strategies in the coming year, with 17% looking for opportunistic returns. The ranking of core-plus increased from 28% in 2025 to 32% in 2026, reflecting a shifting preference for opportunities that prioritize income-driven returns alongside a balanced risk-return profile. Investors ranked retail as its third-highest preference, behind multi-family and industrial/logistics, in line with the results of the 2025 survey. Grocery-anchored centers remained the top choice for retail investors, followed by lifestyle centers and unanchored strips.

PROPERTY SECTORS TARGETED BY U.S. INVESTORS IN 2026 (MULTIPLE CHOICE)

According to the CBRE survey, nearly three-quarters of investors continue to favor direct real estate or wholly-owned real estate assets.

SageTrust Properties is actively in the market to source retail open-air property acquisition opportunities and has the capability to manage its assets. Let us know if you would like to schedule a meeting with us to discuss your needs and our capabilities further.